Boost your sales

European consumers aren't as credit card savvy as the UK or USA based companies. In fact, based on the Eurostats numbers, 60% of the target audience does not have a credit card and use their trusted bank card to buy.

There are no integration techniques of these local banking solutions to provide your application with the same ease-of-use as we know it from credit cards.

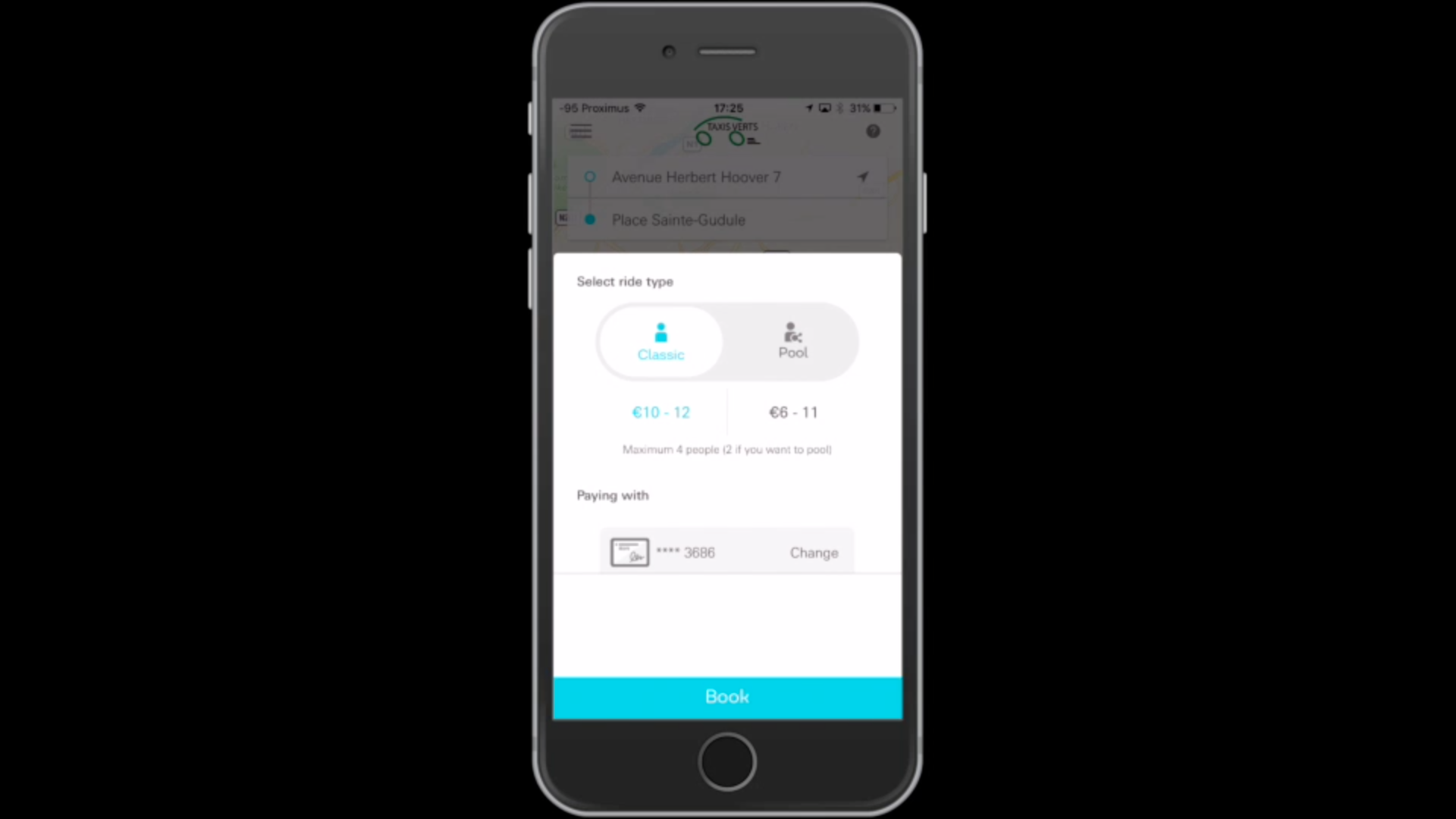

The example of one touch payments at Uber, iTunes or Amazon,... has proven that a full integration will boost sales and makes customers more loyal.

Sign2pay has developed a fully integrated technology allowing you to process all European local bank cards with the same convenience as credit cards.

The main benefits of in-app payments?

Completely integrated in your own customer experience.

The relationship between a merchant and a customer will improve.

Connected customers return to your application more often.

Shopping cart value will increase after a banking account was connected.

Easy

No install based apps, card readers or redirects. Just a personal signature on a touchscreen to sign a SEPA mandate. Once the SEPA mandate is signed every next purchase is just one click away.

Secure

Biometric verification is fast and easy but

also very secure. It allows us to create an unambiguous permission between a merchant and a consumer.

Everyone

One cross-border solution for all debit payments.

In 19 Eurozone countries, for more than 3700 banks, on all touchscreen enabled devices.

Simple Pricing.

For processing one touch payments

our pricing starts at 1,9% + €0,25 per transaction.

Reach out if your processing high volumes to get a tailor made pricing.