GET MORE CUSTOMERS

by digitising and automating your onboarding

As a company you are constantly fighting to expand your customer base. Thinking of new ways to seduce consumers to buy from your company and start a customer relationship. But when they're ready to buy they are faced with the burden of handling paper documents to onboard.

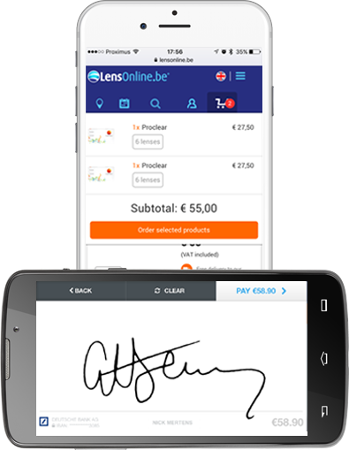

Lose the paper flow and strengthen your digital image with the smoothest experience on the SEPA Direct Debit market.

We reduce friction and increase conversion on all platforms and channels.

Together with sign2pay you can ensure that the consumers who WANT to become a paying customer, WILL become one!

DIGITISE & AUTOMATE

Saving time, money and reduce errors

By accepting and automating SEPA mandates with Sign2Pay you can

- improve the cost structure of collecting your invoices

- improve your brand image through digitisation

- reduce human errors in the process

Integration is done fast and secure via the Oauth2.0 protocol, which we know and love from the facebook login button.

Get the customer to sign the SEPA mandate via either SMS Pincode validation or become compliant with our in-house developed biometric signature.

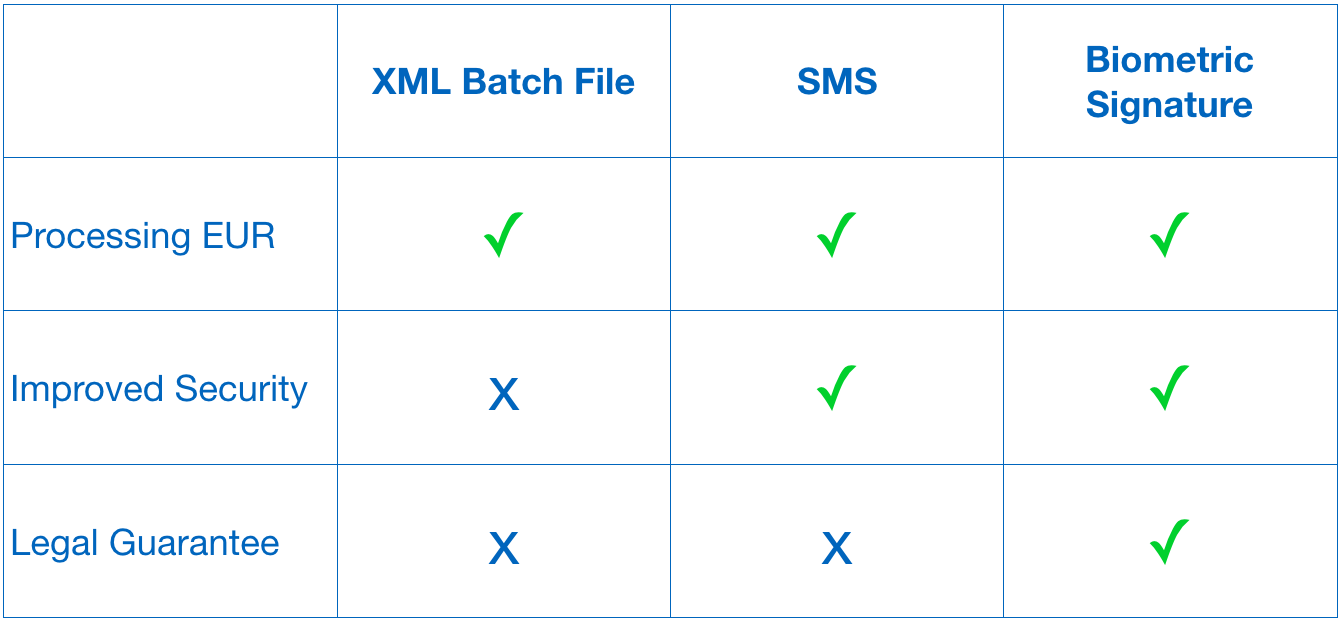

3 SEPA Direct Debit products

Have a look at these integrations with our customers to see how we could help you...

Are you processing paper mandates?

Then XML Batch files can help you manage.

-

Need a basic validation without the need to be PSD compliant,

choose the SMS pincode mandate.

-

Do you want to be compliant and at the same time offer convenience,

the biometric signature mandate has you covered.

Omnichannel

We put a lot of effort in design, as it's the most important ingredient of a successful product. Have your customers convert instantaneously on any device and on any platform.

Eurozone

We process in 19 different European Countries without any effort and more secure than any other supplier.

Credit checks

Performing real-time credit checks and behavioural analysis allowing us to estimate what the quality of a consumer is at any giving moment in time.

Legal e-mandates

Be compliant with the PSD2 regulations without losing customers. Change now if you are still processing paper SEPA Direct Debits.

Competitive pricing

Optimising and automating our systems continuously to improve our efficiency as a company is directly translated in to our pricing models.

Dedicated support

Our integration techniques are top notch. We integrate in your flow through Oauth2 protocols for instant gratification and superior security.

Simple Pricing.

For processing low-risk recurring SEPA Direct Debit mandates,

our pricing starts at €2 per mandate + €0,25 per transaction.

Reach out if your processing high volumes for a tailor made pricing.